🌱 Insure your credits to ensure your impact (psst - we've found 4 partners who can help)

Taking a closer look at carbon credit insurance and our usual dose of good news

Happy Monday! We’re excited to be hitting your inbox in our brand new format today…

Every Monday we’ll suit up and get serious - digging into a climate topic that’s relevant to your brand, like we love to do, so you can look smart at standup. We’ll also share the past week’s Good(s) News and resources from across FTF that might be useful to you. Then, on Thursdays, we’ll be going behind the scenes of your favourite brands in a quick and fun edition we’re naming ‘The Check-Out’ (see what we did there?). Like usual, each edition will be written by our team of enthusiasts from across the ‘consumer goods x climate’ space. When we say by sustainability professionals, for sustainability professionals we really mean it.

Did your April start off as busy as ours? Once you have devoured our focus piece on carbon credit insurance (if you didn’t know that was a thing you are not alone!), read on to find out what we have been up to already this month…including our search for young journalists and writers 👀.

Let’s dive in…

> In Focus

Carbon Credits Insurance — Offsetting The Risk

Written by Indira Ardiyatna

We need to reduced global emissions by 45% by 2030 if we want to have a liveable climate. With only six years to go, pressure for businesses to transition to Net Zero is mounting - with many utilising carbon credits to do so. But, as you’d expect, this comes with risks no matter how high quality the credits are - many projects fail to deliver, or can be ‘junk’ when they do. That’s where insurance can come in.

Quick Refresh: Carbon Credits

A currency that is measured in tonnes of carbon dioxide equivalent (tCO2e), carbon credits represent the avoidance or removal of greenhouse gas emissions through various climate action projects. Examples of these projects are investing in renewable energy or supporting the development of local communities - like the UNFCCC’s e-commerce platform to purchase carbon credits, where companies are awarded with Certified Emission Reduction (CERs). The best carbon credit projects ensure that the carbon they sequester or avoid will remain out of the atmosphere for at least 100 years, since carbon can remain in the atmosphere between 300 to 1,000 years. Read a full 101 here.

Where does insurance come in?

Companies who buy credits need to ensure that the projects they have invested in will actually be done, or they are at risk of carbon credit reversal: where carbon removed by offsetting projects is being released back into the atmosphere. What if your forestry conservation project in a hot, dry climate is affected by a wildfire? Or if it’s absorbed into a new nationalisation project? That’s where you’ll need insurance on the investment, and promise, you just made that now can’t be fulfilled.

How does it work?

Just like normal insurance, carbon credit insurance provides protection against a range of risks like regulatory changes, project failure, and fraud for the carbon offsets purchased. The type of compensation given can vary depending on the company itself or the insurer - some can give back in the form of money or carbon.

The mechanism is simple. The insurance payment creates a large shared pool of spare carbon credits across the world, so that when something happens, this credit pool can be used to make up for the loss. The number of credits that can be issued depends on the risk of the project, where higher risk of reversal needs to commit more credits, enabling equal compensation in case it happens.

Carbon credit insurance can also help to promote projects that reduce greenhouse gas emissions, as having a safety net for investors can help mitigate the risk associated with the project. This encourages more investment in initiatives that contribute to mitigating climate change. Win!

Let’s take a look at partners…

As this is an emerging market, there are some early partners that your company can work with to insure your carbon credit investments:

Oka, The Carbon Insurance Company: Their ‘Carbon Protect’ solution provides companies with financial compensation. They have a wide range of coverage, from natural catastrophes, human-induced activity, or over-crediting (where projects have incorrectly quantified emissions).

Kita: They offer bespoke portfolio carbon insurance products and protect clients against various loss of carbon credits. The insurance claims can be paid in cash or in replacement carbon credits from their Carbon Supplier Pool to provide flexibility.

CarbonPool: Their carbon insurance pays claims in credits, where their insurance types are broken down into categories: shortfall insurance (natural disasters, accidents), reversal insurance (replacing carbon lost due to reversal events) and unintended emissions (temporary disruptions in technology or machinery)

Howden: As a global insurance company, they are also offering bespoke insurance to protect companies from leakage of CO2 from commercial scale carbon capture and storage facilities (CCS) or from the voluntary carbon market (VCM).

By taking this extra step to insure carbon credits, businesses will hopefully ensure their cash ends up actually having an effect - avoiding the chance of paying a bigger penalty down the line should proven fraud, reversal or any kind of incident affect validity and delivery. It goes without saying, carbon credits should never be the starting point of your sustainability strategy, but since they remain a major element of most Net Zero strategies - it can’t hurt taking some of the risk out of the investment.

> Follow up with…

Resource: The 1.5°C Business Playbook

Resource: The Ultimate Guide To Carbon Credits

> Last week in consumer goods x climate…

The Good(s) News

Up and coming brands…

🎯 Chilly's launched their 90% Recycled Stainless Steel bottles made from post-consumer recycled steel. This launch is part of their goal to only use recycled steel for their newly designed products from 2024.

Bigger organisations…

⭐️ Upfield launched their 100% plant-based butter alternative, Flora, into Carrefour stores in France. From a study by Quantis, Flora has an 80% lower carbon impact than butter.

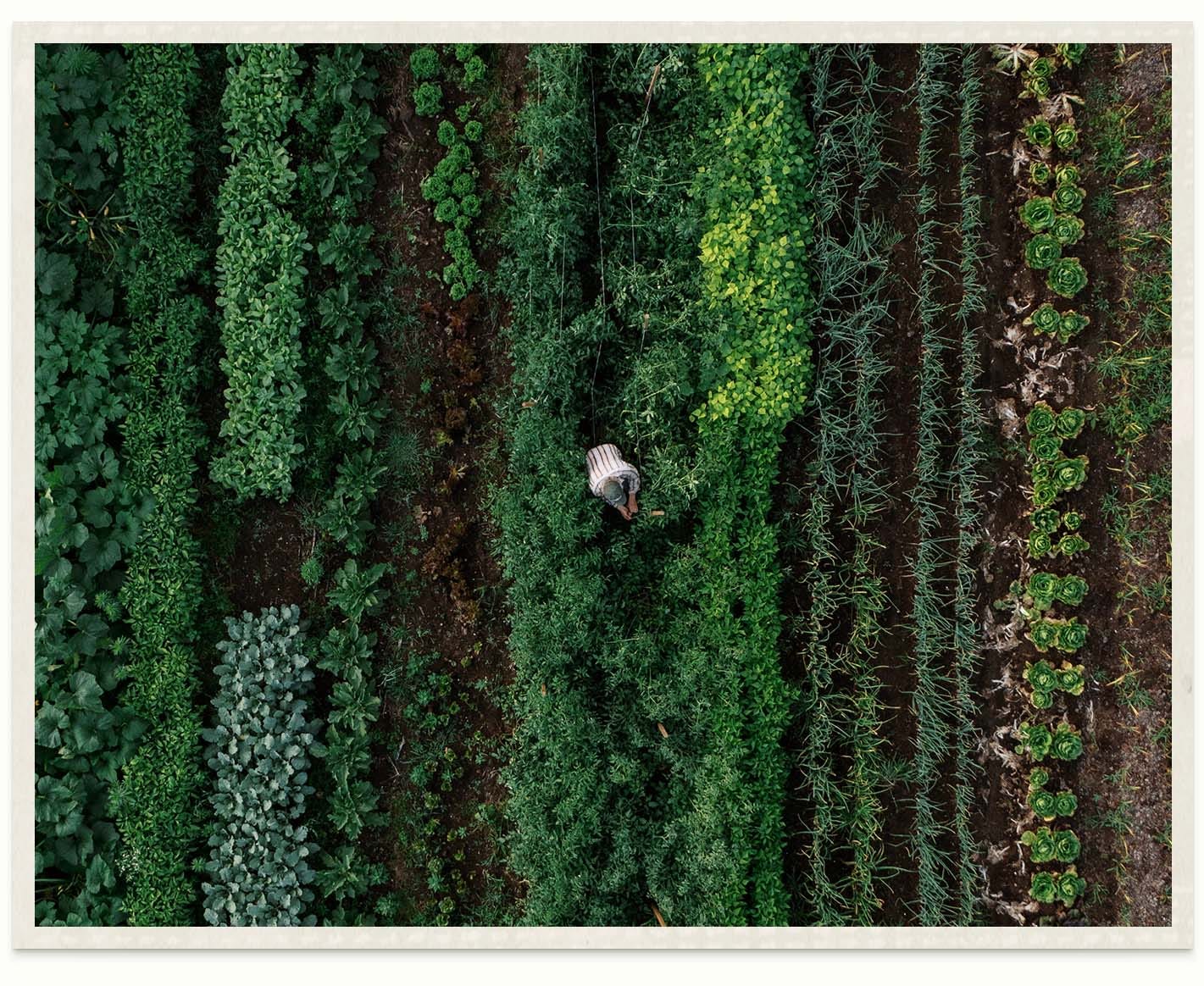

⭐️ Anthropologie have partnered with Kiss The Ground as a 10k Acre Partner in celebration of Earth Month. The partnership will support the adoption of regenerative farming practices across ten thousand acres, specifically for regenerative textile crops, like cotton, used in Anthropologie's products.

⭐️ ThredUp released their 2024 resale report. It highlighted that the clothing resale market grew 15 times faster in 2023 compared to the larger clothing sector, and they predict the clothing resale market to more than double by 2028.

⭐️ Conimex, Fairtrade Original, Jumbo Supermarkten, Knorr, Koh Tai, Patak’s and PLUS Retail in the Netherlands have all agreed to make at least 50% of the example recipes on their product packaging vegetarian or vegan - following a campaign by the Dutch animal rights group, Wakker Dier.

⭐️ Arla Foods announced their new fermented beverage concept. It will use upcycled acid or whey to make a drink which can be produced using the same production lines as yoghurt, lowering the cost of initial investment.

Industry wins…

⚡️Environment Agency announced updates to its charges for regulating waste shipments. The new charges will reflect the complexity of regulating different waste types needed to protect people and the environment from the impacts of hazardous waste.

Want good news sooner? We post our top 5 stories every Friday on LinkedIn! If your CPG brand has good news to share, let us know.

> In case you missed it

Want more? Here’s what’s happening across FTF…

Know a budding young journalist? We’re looking for co-writers for our Earth Day 2024 content! Submissions are due by 12pm GMT on 15th April.

FOMO keeping you up at night? We rounded up seven of April’s best ‘climate x CPG’ events for you to choose from.

We’re always adding new impact accounting partners to our MEASURE database. Seismic, Energise, carbmee, Planet FWD and Regrow are our latest, see the updates here (and see what on earth the MEASURE database is here).

We got some love on LinkedIn! Hearing feedback from you really does make our day.

Working on sustainability in a consumer goods brand? We’d love to hear from you - first, for a cool once-a-week group chat we’re trialling, and second for an upcoming brand spotlight (it’s your time to shine!).

Finally - last week we wrote about the ‘Empowering Consumers for the Green Transition’ directive, and took a look at Wiper and True’s really cool carbon capture tech (field trip anyone?). Catch up on Newsletter #132 here.

That’s it for today!

Want more? Check out ‘The Check-Out’ this Thursday for the latest brands in our basket. In the meantime, if you miss us, reply to this email or reach out at info@followingthefootprints.com to say hi. We’re always on the hunt for contributors, cool brands, and climate memes.

Much love,

Team FTF